In a world where avocado toast can cost a small fortune, saving money feels like a superhero mission. Enter savings apps—the trusty sidekicks that help users conquer their financial foes. These digital marvels make it easier than ever to stash away cash without sacrificing the lattes or the occasional weekend getaway.

Table of Contents

ToggleWhat Are Savings Apps?

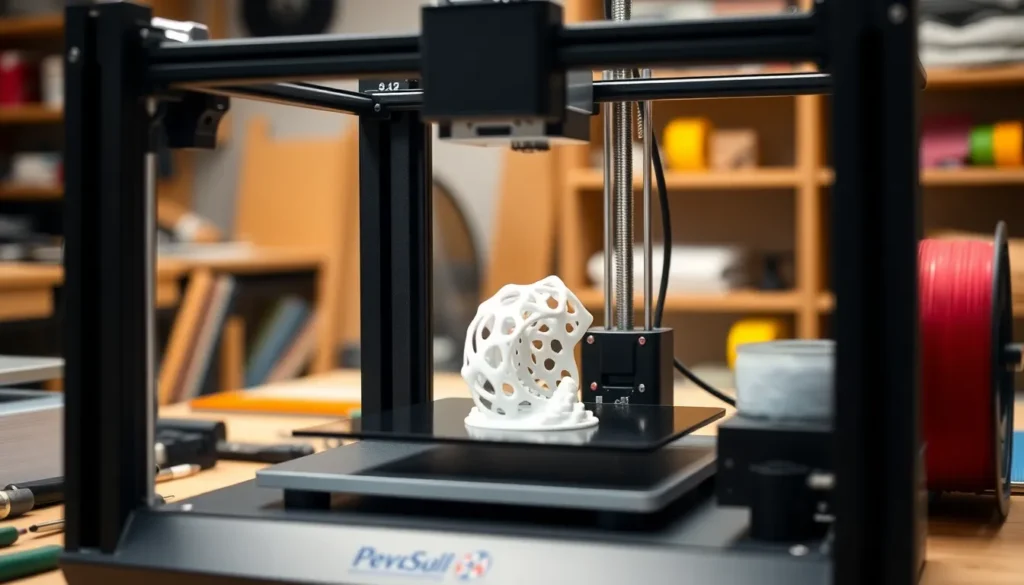

Savings apps are digital tools designed to help individuals save money efficiently. They simplify the savings process by offering features that automate and streamline financial management. Users can set savings goals for vacations, emergencies, or large purchases.

Many savings apps analyze spending habits, allowing users to identify areas where they can cut back. Programs often round up purchases to the nearest dollar, depositing the difference into a savings account. Other apps enable automatic transfers from checking accounts to savings accounts, ensuring that users save consistently.

Furthermore, these applications provide insights and tips to enhance saving strategies. They help users stay informed with notifications, encouraging regular contributions to savings. Some savings apps even offer rewards for reaching financial goals, making saving more motivating.

Security remains a priority for these apps, with encryption and other features designed to protect user data. Most platforms partner with reputable financial institutions, ensuring transactions remain secure. Enhanced safety measures foster user confidence and encourage broader adoption.

As the digital landscape evolves, some savings apps incorporate features like budgeting tools and investment options. Such integration enables users to manage all aspects of their finances in one place. Users benefit from real-time data that helps them make informed financial decisions.

Savings apps signal a shift in how people approach money management. They challenge traditional savings methods by offering innovative solutions that fit modern lifestyles. Combining convenience with technology, these apps reshape financial habits for a sustainable future.

Benefits of Using Savings Apps

Savings apps offer a range of features that enhance users’ financial management and savings processes. These digital tools simplify saving and encourage users to build financial security over time.

Increased Savings Potential

Automation increases the likelihood of saving consistently. Savings apps often round up purchases to the nearest dollar, collecting spare change. For instance, if a user buys a coffee for $3.50, the app transfers $0.50 to savings. This small adjustment compounds over time, leading to significant savings without impacting daily spending. Users frequently report an increase in their savings balances within months. Statistics indicate that individuals using these apps can save up to 30% more than those who do not.

Goal-Oriented Features

Goal-setting transforms saving into achievable targets. Savings apps allow users to specify goals, such as vacations or emergency funds, giving a clear focus to their savings efforts. Users track their progress visually through engaging interfaces. Motivation increases with the ability to set deadlines and milestones. For example, an app might highlight a user’s savings journey toward a $1,000 vacation fund. Notifications remind users of their goals and encourage consistent contributions. This structured approach makes saving more rewarding and helps users stay committed to their financial plans.

Popular Savings Apps in 2023

Numerous savings apps emerged in 2023, each offering unique features to aid users in their financial management. These apps simplify the saving process, enabling users to achieve their financial goals while enjoying their daily lives.

App 1: Features and Ratings

App 1 stands out for its intuitive user interface and comprehensive savings tools. Users can customize their savings goals, with options for multiple targets such as vacations or emergency funds. Automatic rounding up of purchases enhances the saving process, contributing additional cents to users’ savings accounts with each transaction. This feature fosters consistent saving. Furthermore, the app boasts a 4.8 out of 5 rating on app stores, reflecting high user satisfaction. Notifications encourage regular contributions, making it easier for users to stay on track.

App 2: Features and Ratings

App 2 offers innovative features that attract a diverse user base. Notably, users can create specific savings challenges, turning saving into a game-like experience. Integration with budgeting tools allows for a holistic view of users’ finances. With an average rating of 4.6 on various platforms, this app supports users in maintaining their financial health. Regular tips and insights inspire users to refine their spending habits substantially. Automated transfers facilitate effortless saving, allowing users to focus on their goals without added effort.

Tips for Maximizing Savings with Apps

Savings apps become more effective when users implement strategic methods. These tips enable users to enhance their financial management experience.

Setting Realistic Goals

Setting achievable savings goals increases success rates. Users should define specific targets, such as saving for a vacation or emergency fund. Break larger goals into smaller milestones to maintain motivation. For instance, aiming to save $1,200 for a vacation translates to saving $100 monthly. Achieving these increments provides a sense of accomplishment. Users benefit from the visual tracking features that many apps offer. This visualization reinforces progress and keeps users engaged. Focus on the timeline for each goal, ensuring it aligns with personal financial circumstances. With a clear roadmap, users feel more in control of their finances.

Automating Savings

Automating savings drastically simplifies the process. Automatic transfers from checking accounts to savings accounts help build savings without effort. Users can set up recurring transfers to ensure consistency in their saving habits. For example, users might schedule a transfer of $50 each week. This method reduces the likelihood of overspending and missing contributions. Savings apps that offer rounding up purchases provide additional savings effortlessly. Every purchase gets rounded to the nearest dollar, with the difference directed to savings. By embracing automation, users enhance their likelihood of reaching savings goals without added stress.